Ohio Capital Finance Corporation

Preservation, Expansion, and innovation marked three of the accomplishments for OCFC in 2020. Led by the implementation of The 614 for Linden and the expansion of the Ohio Affordable Housing Loan Fund, OCFC provided over 700 loans to affordable housing developers with total production exceeding $650M and assisted with the production and preservation of over 29,000 units.

INNOVATION

OCFC worked to implement The 614 for Linden initiative which is seeking to revitalize a disinvested neighborhood on the northeast side of Columbus. The 614 for Linden is a collaborative named for six nonprofits partnering with four community development financial institutions (CDFIs) to have a positive and significant impact on one Columbus neighborhood, Linden. Its mission is to create and preserve affordable housing and commercial development, as well as to provide access to capital for small businesses, and offer health services to residents. OCFC serves as the co-lead on the housing work and developed a $20M pool of funding for affordable housing development in Linden. The Year 1 Progress Report is available to learn more about The 614 for Linden initiative: www.the614forlinden.org.

Additionally, OCFC was the recipient of the competitive 2020 CDFI Financial Assistance program. OCFC will utilize its $650,000 award to create a $4M Fund of flexible capital to build and rehabilitate affordable, high-quality rental housing for the people of South Linden. The fund will focus on building 17 new affordable rental housing units and rehabilitating three others.

EXPANSION

Since the creation of the Ohio Affordable Housing Loan Fund (“Loan Fund”) in 2004, it has produced 265 loans, generated over $110M in loan production while incurring zero losses. In 2020, the investors in the Loan Fund agreed to extend the fund for additional five years while also increasing the capital available for lending to $27M. This stable pool of capital revolves to meet the needs of affordable housing developers and provide a full-range of products including predevelopment financing, acquisition financing, equity bridge and construction loan financing.

OCFC provided the patient financing to develop and construct this mission-based small business in the King Lincoln neighborhood of Columbus. This marks the expansion of OCFC work to engage in broader community development activities. This unique business, What the Waffle, assists young women exiting foster care to develop skills in the culinary arts while furthering their education through a partnership with Columbus State.

Jonathan Welty, President, OCFC; Gayle Troy, Owner of What the Waffle; Aaron Murphy, Vice President of Community Development Lending, OCFC; Eric Troy, Owner of What the Waffle

PRESERVATION

In 2009, through a competitive application process, OCFC with its partners, OHFA, COHHIO and OCCH received a $5M award from the John D. and Catherine T. MacArthur Foundation to spur a public private initiative seeking to preserve affordable housing in Ohio. In 2010, OCFC launched the $18M Ohio Preservation Loan Fund with the intent of providing predevelopment, acquisition and bridge loans to preservation minded developers. Ten years later, OCFC’s goal of seeing preservation embedded in the affordable housing lexicon has been realized with multiple resources, including those of OCFC are now available to assist developers.

OCFC successfully concluded the OPLF in 2020 by returning all original capital to the lenders after never missing an interest payment or having any loan default. After a decade of lending, the OPLF closed 78 loans totaling nearly $93.6 million, exceeding its original lending goal for the Fund to revolve four times over to assist in the preservation of 5,487 units and helping to create 8,905 jobs.

OCFC engaged the Greater Ohio Policy Center to study the impact of the OPLF. The 10-Year Community Impact Report can be found here: ohiopreservationcompact.org/resources.aspx.

OCFC operates five revolving loan funds:

– Ohio Affordable Housing Loan Fund

– Ohio Preservation Loan Fund

– OCFC Capital Magnet Loan Pool

– Southside Renaissance Fund

– Cincinnati Neighborhood Transformation Fund

OCFC is a Community Development Financial Institution (CDFI) Entity, as certified by the United States Department of the Treasury.

Member of:

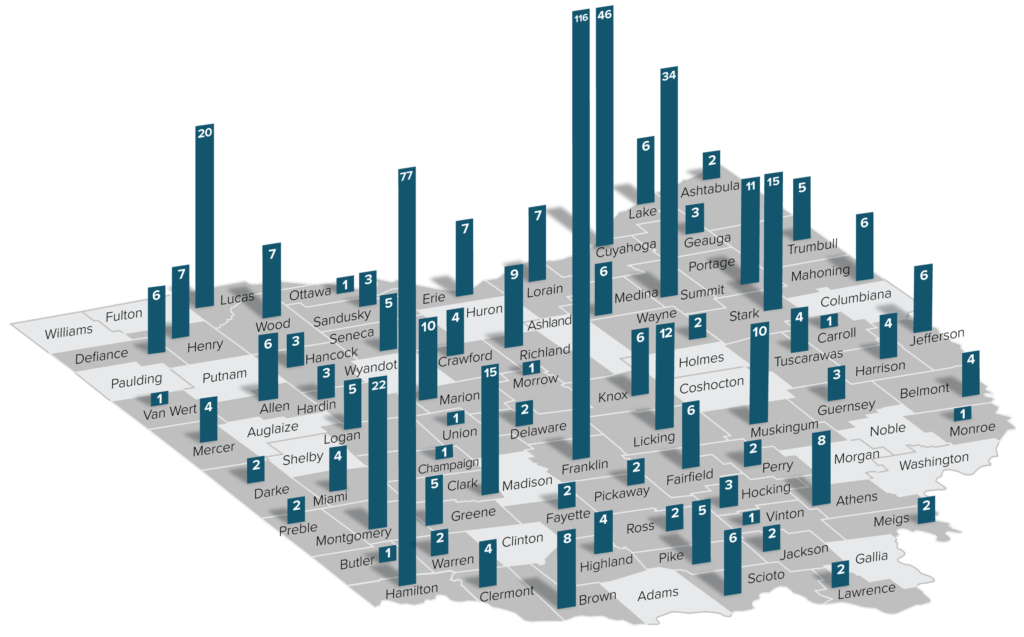

Ohio Loans by County

OCFC has provided loans in 78% of Ohio’s counties.

OCFC’s mission of “providing a flexible source of capital to increase and improve the supply of affordable rental housing across Ohio” has remained steadfast while expanding to meet market needs.

OCFC Partners

Since 2002, OCFC has generated nearly $668 million in 718 loans utilized to develop and finance 29,105 units of affordable housing (36% of which were preservation) across Ohio. OCFC is grateful to its investors and participants for their commitment to affordable housing while being mindful of the needs of its borrowers.

Accomplishments 2002-2020

Units financed (36% of which were preservation)

Loans closed

Total loan production

Ohio counties (78%) in which loans have been made

2020 Loan Production Distribution

Number of Loans

Hover over the pie chart for more details about each type of loan.

Predevelopment

Acquisition

Equity Bridge/Construction

Permanent

Amount of Loans

Hover over the pie chart for more details about each type of loan.

Predevelopment

Acquisition

Equity Bridge/Construction

Permanent